Your cart is currently empty!

Author: admin

-

Peek into our short idea generation process.

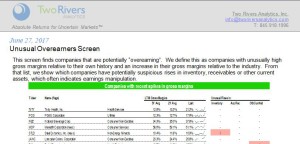

This report went out to clients last week. Suspicious Overearners: This model seeks companies that are potentially “over-earning”, defined as companies with unusually high margins relative to their own history or relative to the industry. This week we feature overearning short candidates: Dick’s (DKS), Nucor (NUE), Atkore (ATKR), HCA Hlth (HCA), Danaher (DHR), and Calif Water Svc Read more

-

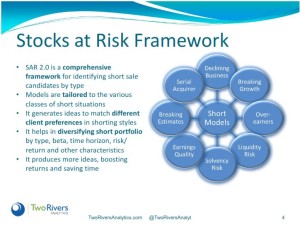

Our Short Process

Attached is an updated “short” presentation on our investment process. Click here to download: TRA Process & Bio 20210810 Read more

-

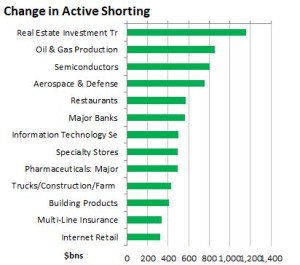

Shorts rising in REITs, E&Ps, Semis, Aerospace, Restaurants

This report shows: • spikes and drops in short interest by industry; • notable stocks showing spikes in short interest; and • short squeeze candidates reporting very soon The market value of short interest increased by 4.8% ($37.6) billion over the past 30 days. Net new active shorting increased by $5.8 bn. The strongest short Read more

-

Short squeeze candidates + Short investor movements

We are introducing our improved short squeeze screen. The idea behind it is simple: * Heavily shorted stocks, * where short exposure has increased meaningfully very recently and * where the stock price is rising fast, create the perfect conditions for squeezes. Weak short hands could be forced out on market-moving news. The screen highlights Read more

-

Suspicious Overearners

This screen finds companies that are potentially “overearning”. We define this as companies with unusually high gross margins relative to their own history and an increase in their gross margins relative to the industry. From that list, we show which companies have potentially suspicious rises in inventory, receivables or other current assets, which often indicates Read more

-

New shorts in Health Tech, Energy and Transports

The market value of short interest increased by 7.0% ($44.0) billion over the past 30 days. Net new active shorting increased by $8.5 bn. The strongest short activity was seen in Health Technology, Energy and Transportation. The weakest short activity was seen in Consumer Services, Health Services and Consumer Durables (Chart 2). Consumer Durables, Non-Energy Minerals and Read more

-

Memory Lane: “Buy Enron” report

Students of stock market history will want to keep a copy of this report on hand. Might serve as a warning of what happens during stock market bubbles…. This is a Buy recommendation on Enron published by Bear Stearns in 2001: Enjoy. ENE_BearStearns_20010126 Read more

-

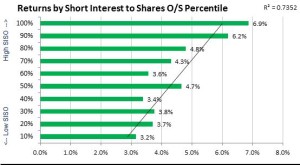

Short covering in Tech, Tech Services & Consumer Services

Short investors continue to suffer. High SISO names are not only rising, but outperforming the broader market. This is the stuff of “risk-on” cycles in the market that often lead to strong returns for shorting subsequently. Click here for the Short Update, including charts on short interest by sector and stocks showing the largest spikes and Read more

-

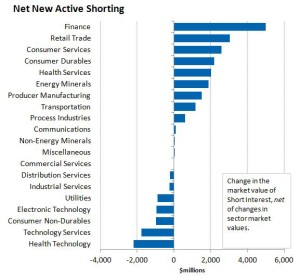

Short Investors piling into Financials & Retail; Covering bets in Health Tech & Tech Services

The market value of short interest increased by 2.9% ($18.6) billion over the past 30 days. Net new active shorting increased by $12.7 bn. The strongest short activity was seen in Finance, Retail Trade and Consumer Services. The weakest short activity was seen in Health Technology, Technology Services and Consumer Non-Durables (Chart 2). Consumer Durables, Read more

-

Two Rivers speaks at FactSet’s Investment Symposium

FactSet put on a great program in Washington, DC earlier this week. The keynote speakers were ex-Fed Chair Ben Bernanke and Colin Powell. Two River’s Eric Fernandez spoke on short investment process and model-building. Here are the slides for his presentation. Read more