Author: admin

-

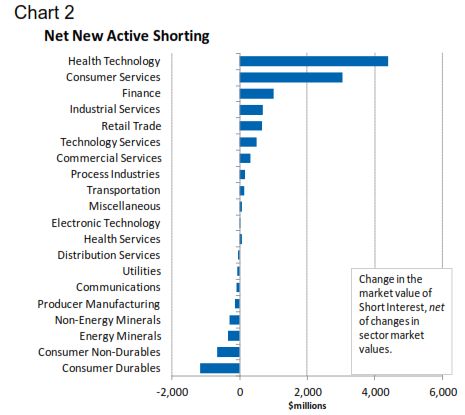

Short investors moving into Health Tech, Energy and Communications

Total short market value increased over the past 30 days rising 3.8%. Yet net new active shorting decreased $9.1bn. The largest increases were made in Health Tech, Energy and Communications. The biggest reductions in short interest were made in Finance, Tech and Consumer Services. Consumer Durables, Non-Energy Minerals and Distribution Services have the highest Short… Read more

-

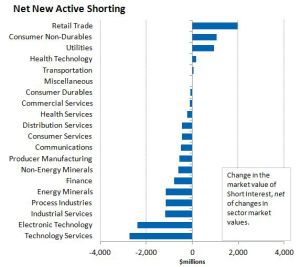

New active shorting declined but spikes seen in retail, consumer non-durables and utilities

Total short market value increased 5.9% ($35.5bn) over the past 30 days. Net new active shorting declined $8.1bn as the snapback rally of late October hurt the shorts. The largest increases in net new shorting are seen in Retail, Consumer Non-Durables and Utilities; the largest drops are seen in Technology and Tech Services. Consumer Durables… Read more

-

Subprime Auto Finance. A bubble inflating.

See our co-authored post on Seeking Alpha: Auto Finance: Another Subprime Bubble? Read more

-

Ferrari or VW Bug? Same price, you pick.

Valuations are converging: What are the implications? Investors are not differentiating enough between companies. Value indifference creates opportunity for active managers. Market declines will be sharper. Managers should become more conscious of valuation and implement strategies along growth and quality lines. (If you could buy and sell any number of Ferraris and used VW Beetles… Read more

-

Alpha generated on short recommendations, update

We track performance for two sets of stock recommendations: 1) stocks from Company Reports and 2) stock warnings from Stock at Risk updates. The weekly Stock at Risk updates are based primarily on Stocks at Risk model results. The Company Reports are published after further fundamental analysis. 1. Performance of Stocks from Company Reports Short… Read more

-

Kate Spade: Trees don’t grow to the sky

Kate Spade’s (KATE) stock closed down hard after rising 10% this morning on a strong earnings report. What changed in a few short hours? The press release revealed healthy 49% Y/Y sales growth and a 5 cent EPS when the market was expecting slower growth and only breakeven results. But when Craig Leavitt (Co-Pres and COO)… Read more

-

A new day for short investors?

“Five Years of Futility Breaking for Bears as Shorts Drop” – Bloomberg. The article describes a positive turn for short investing. “You were seeing the winners win and the losers lose so we actually thought that this could be a really good year for shorting,” Mark Yusko, CEO of $4bn Morgan Creek Capital Management LLC Read more

-

Stop using stops!

This topic draws passionate opinions from seasoned investors on both sides of the argument. We have encountered short investors who cut losses if a stock moves 8% against them and we have encountered investors who will add to losing short positions if they still believe in their original thesis. The question is whether or not… Read more

-

It pays to follow the short sellers

It pays to follow what short sellers are doing. Notwithstanding concerns about high short interest and short squeezes, backtesting has shown that stocks with the highest levels of short interest underperform the market – meaning the “shorts” produce results for their investors. The shorts, as a group, are good analysts, bringing skepticism and skill to… Read more

-

What Ails The Shorts?

Oct 15, 2013. The shorts are clearly getting hurt. High days to cover stocks are outperforming – meaning losing money on an absolute and relative basis for short investors. Ranking all stocks by SISO, the highest 10% of SISO stocks gained 12.1%, the next 10% highest gained 12.8%. The lowest 10% of SISO stocks gained… Read more