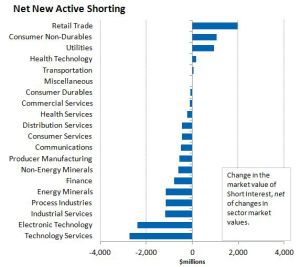

Total short market value increased 5.9% ($35.5bn) over the past 30 days. Net new active shorting declined $8.1bn as the snapback rally of late October hurt the shorts. The largest increases in net new shorting are seen in Retail, Consumer Non-Durables and Utilities; the largest drops are seen in Technology and Tech Services. Consumer Durables and Minerals continue to have the highest Short Interest to Shares Outstanding (SISO), followed by Distribution Companies.

Click here for the report that went to clients earlier this week. Includes stocks showing recent spikes and drops in short interest.

Spread the love