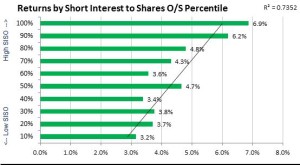

Short investors continue to suffer. High SISO names are not only rising, but outperforming the broader market. This is the stuff of “risk-on” cycles in the market that often lead to strong returns for shorting subsequently.

Click here for the Short Update, including charts on short interest by sector and stocks showing the largest spikes and drops in short interest. (Chart numbers below refer to charts in the report.)

The market value of short interest increased by 2.7% ($16.9) billion over the past 30 days. Net short covering totaled $9.6 bn. The strongest new short activity was seen in Producer Mfg, Communications and Utilities. The highest short covering activity was seen in Electronic Technology, Consumer Services and Technology Services (Chart 2). Consumer Durables, Minerals and Distribution Services have the highest short interest to shares outstanding (SISO, Chart 3)

Short interest spikes in Consumer Discretionary include Tempur Sealy (TPX), Fitbit (FIT) and Polaris (PII). In Health Tech, they included Exact Sciences (EXAS), bluebird bio (BLUE), Endologix (ELGX), Alder Bioph (ALDR) and ZELTIQ (ZLTQ). In Finance, NorthStar Realty (NRF), Digital Realty (DLR), Bank of the Ozarks (OZRK), Seritage (SRG) and LendingTree (TREE).

Stocks at risk of short squeeze include Insys Therapeutics Inc (INSY), Zeltiq Aesthetics Inc (ZLTQ), Ebix Inc (EBIX), Air Methods Corp (AIRM), Gamestop Corp (GME), Outerwall Inc (OUTR), Lannett Co Inc (LCI) and Adeptus Health Inc (ADPT).