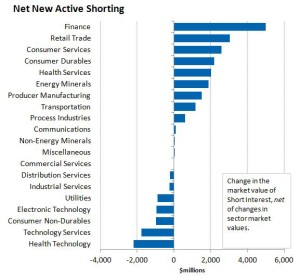

The market value of short interest increased by 2.9% ($18.6) billion over the past 30 days. Net new active shorting increased by $12.7 bn. The strongest short activity was seen in Finance, Retail Trade and Consumer Services. The weakest short activity was seen in Health Technology, Technology Services and Consumer Non-Durables (Chart 2). Consumer Durables, Minerals and Distribution Services have the highest Short interest to shares outstanding (SISO, Chart 3).

Short interest spikes in Finance include Primerica, Inc. (PRI) and LPL Financial Holdings Inc. (LPLA). In Retail Trade, spikes include Lands’ End, Inc. (LE), Big Lots, Inc. (BIG) and Ascena Retail Group, Inc. (ASNA),

Stocks at risk of short squeeze include Financial Engines Inc (FNGN), Encore Capital Group Inc (ECPG), Gamestop Corp (GME), Theravance Inc (THRX), Myriad Genetics Inc (MYGN), Neustar Inc (NSR), Athenahealth Inc (ATHN) and Iridium Communications Inc (IRDM).