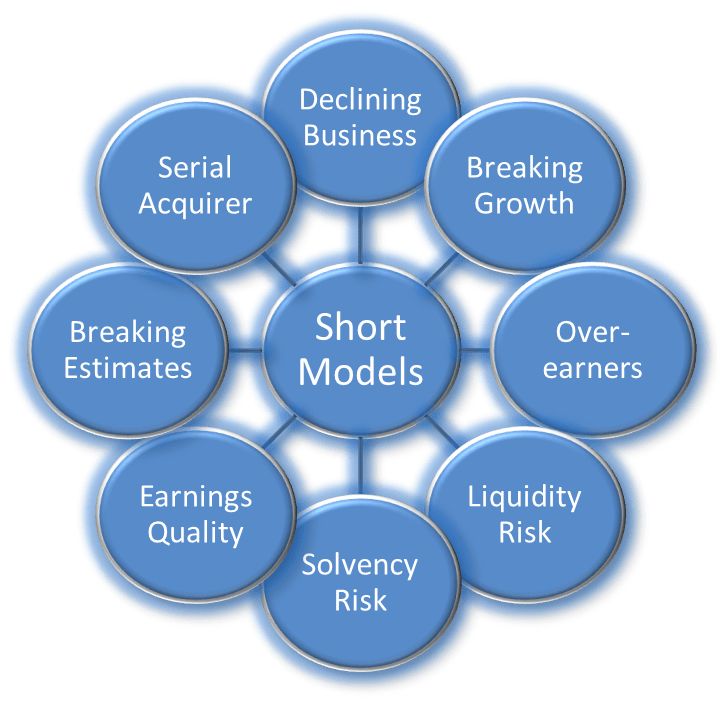

Stocks at Risk Framework

Our model-driven fundamental approach allows us to sort through thousands of companies each with hundreds of datapoints continuously to identify underlying problems, outliers and trend changes.

We sort through all non-financial US equities with market capitalizations greater than $750mn that meet minimum share price and trading volumes.

Guiding Principle:

Weak business momentum continues

Key Questions:

Ongoing decline or possible reversal?

Guiding Principle:

Acquisitions hiding weak fundamentals.

Key Questions:

Are acquisitions masking poor organic growth or financial deterioration? Is acquisition accounting hiding expenses or serial write-offs?

Guiding Principle:

Growth slows causing re-rating. Is slowdown temporary?

Key Questions:

What is the catalyst?

Guiding Principle:

Sudden cuts in sales or earnings estimates

Key Questions:

Are the cuts warranted? Is the issue(s) temporary?

Guiding Principle:

Margin improvements are unsustainable or fraudulent

Key Questions:

Sustainable? Cyclical pull-back?

Guiding Principle:

Unsustainable or artificial earnings.

Key Questions:

Does accounting hide material weaknesses? Catalyst?

Guiding Principle:

Insufficient cash to meet debt or operating loss cash needs.

Key Questions:

Will company run out of cash? Can they refinance?

Guiding Principle:

Company is unable to overcome debt

Key Questions:

Will company run out of cash?

Fundamental Research

While the Stock at Risk models add value by themselves, fundamental analysis forms the bridge to fully-formed short ideas. Our analysis begins with the Stock at Risk model results which serve as tentative short theses (Declining Business, Overearner, etc..). A preliminary thesis is developed and confirmed (or rejected) by digesting all relevant SEC filings, earnings call transcripts, investor presentations, press releases and public industry sources. We analyze the company’s marketplace and competitive position for insights into drivers of future earnings and value.

Most importantly, we identify catalysts for the realization of a short thesis. We work hard to present the findings in as balanced a manner as possible for any short recommendation. A fully developed discussion is provided in every report.

Research Themes Include:

- Continuation of poor business momentum

- Poor business models

- Slowing growth, either secular or cyclical

- Unsustainable excess profitability including pulling sales forward and/or temporary margin expansion

- Inventory or receivables build-up foreshadowing sales declines and/or margin compression

- Improper capitalization of expenses or other questionable accounting practices

- Insufficient cash flow for debt service or looming debt maturities

- Conflicts between growth investment and debt service or dividends