Tag: short selling

-

Our Short Process

Attached is an updated “short” presentation on our investment process. Click here to download: TRA Process & Bio 20210810 Read more

-

Short squeeze candidates + Short investor movements

We are introducing our improved short squeeze screen. The idea behind it is simple: * Heavily shorted stocks, * where short exposure has increased meaningfully very recently and * where the stock price is rising fast, create the perfect conditions for squeezes. Weak short hands could be forced out on market-moving news. The screen highlights… Read more

-

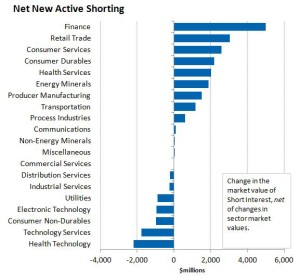

Short Investors piling into Financials & Retail; Covering bets in Health Tech & Tech Services

The market value of short interest increased by 2.9% ($18.6) billion over the past 30 days. Net new active shorting increased by $12.7 bn. The strongest short activity was seen in Finance, Retail Trade and Consumer Services. The weakest short activity was seen in Health Technology, Technology Services and Consumer Non-Durables (Chart 2). Consumer Durables,… Read more